auto low cost auto cars car insurance

auto low cost auto cars car insurance

An insurance binder offers short-term evidence of insurance policy coverage prior to the issuance of a formal insurance coverage. People usually require home and also auto insurance coverage binders to give evidence of insurance protection when buying a house with a home loan or a new automobile with a car financing (credit score). The insurance binder specifies all the defenses for which you are covered while you await a new plan, in addition to any type of coverage restrictions, deductibles, costs, terms.

What is an insurance coverage binder? The interpretation of an insurance binder is a short-lived insurance policy agreement that supplies the binder holder totally effective insurance protection while they await the formal issuance, or in some instances denial, of an insurance policy. Lugging an insurance binder implies there is a written legal contract between you as well as the insurer, giving for a specific time period, normally till a common plan is issued. car.

The expiry day of on insurance coverage binder is normally within 30-90 days of issuance. Upon expiration, the insurance binder will no more remain to give you with. Many insurance policy binder forms or themes are issued by the Association for Cooperative Workflow Research as well as Growth (ACORD), a not-for-profit that offers insurer with information and also application standards.

The insurance policy binder can help you validate the protections you have actually gotten are accurate and eventually verify you are insured. And also the insurance binder can help you verify the coverages you have looked for are accurate and also ultimately verify you are insured. Money your property You will also likely need an insurance binder if you are funding your automobile, residence or commercial building with a lending.

If your insurance plan is not available at the time of lending issuance, you can offer proof of insurance to the bank or lender with an insurance binder. perks. Buy a brand-new house or auto 2 of one of the most usual instances of insurance coverage binder use are in instances of purchasing a residence or a cars and truck.

Some Ideas on What Is An Auto Insurance Binder? You Need To Know

Never be reluctant to comply with up with your service provider to determine the condition of your insurance plan, and make certain to ask for a copy of the brand-new insurance coverage agreement if you do not receive one upon issuance - cheaper.

An insurance coverage binder shows the arrangement made in between you and also the insurer. It validates in writing that a policy will be issued. The binder is proof of insurance that you can use until you get your real strategy. It may be released for a minimal time and also have an expiry date.

It's provided by a licensed agent. It works as proof of insurance for your residence, home, or auto - dui. Your binder will certainly detail the fundamental terms, coverages, deductibles, and named insureds that will certainly show up in your agreement. A binder is subject to all the terms of the pending agreement, unless it is noted or else.

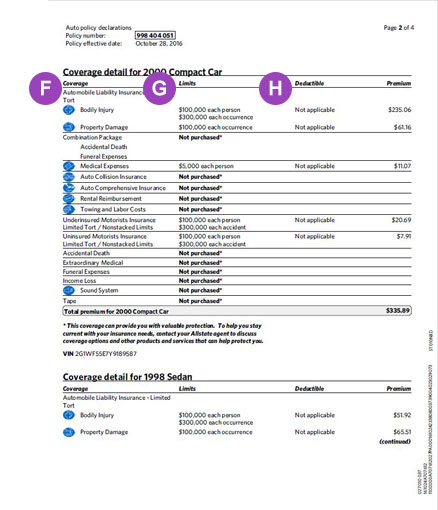

It should include seven key aspects - cheap car insurance. Threat The binder need to plainly state the risk, or what is guaranteed. It must include the cars and truck's make, model, and lorry recognition (VIN) if it's for a car. It must include the insured place address and the quantity of insurance on the home (home worth guaranteed) if it's for a home.

Responsibility The binder need to mention the quantity of responsibility insurance coverage. It will certainly show the limits to coverage for the called insured(s) as well as the residential or commercial property. Deductibles and Protection Purviews The binder must mention the insurance deductible for each section of insurance on the automobile, the residence or home. The kinds of protection and also limitations for each must also be pointed out.

All about Insurance Binders: What Are They? - The Balance Small ...

The Insureds The binder should name all persons that are insured, as well as any kind of added insureds. insurance company. Other insureds could include a co-owner if a residential or commercial property is in one or even more individual's names.

The Business The binder need to plainly specify the name of the insurance firm. The Term The binder will plainly determine the term of the insurance coverage: the date the insurance policy goes right into effect and also the day when it expires.

Binders might also consist of disclaimers that will claim that it's subject to the terms of the plan wording. Who Requirements an Insurance Coverage Binder?

Having the binder will certainly be crucial if you need to make a claim prior to the records show up. Car Insurance Binders A cars and truck insurance binder is commonly used to confirm that you have actually insured your automobile. It may be called for by a car dealership, a leasing firm, or a finance business when you're buying a new auto.

Clauses that relate to any type of financing firms ought to also appear. Home Insurance Policy Binders A home insurance policy binder is made use of to show that you have coverage on your house. It's most frequently utilized when you're shutting on a brand-new property so you can confirm to the lending institution or home loan business that the home is guaranteed (auto insurance).

The 9-Second Trick For What Is An Insurance Binder? - Getjerry.com

He can overlook the binder when he receives the actual insurance coverage policy since that will include the full details. An insurance binder should be issued as soon as you request to purchase an insurance policy plan.

It can take a few days for a firm to refine all the paperwork required prior to a plan is issued. The binder is an essential component of verifying that you're guaranteed in the meanwhile - car insurance.

What If You Never Ever Get the Policy? A binder doesn't replace it. There might be a significant trouble if you have not gotten your policy before your binder expires.

Frequently Asked Questions (Frequently asked questions) How lengthy is a binder great for? The binder should be valid for a set term that's composed on the document.

If you haven't received your official records, as well as your insurance coverage binder is about to run out, you'll desire to comply with up with an insurance agent. Wellness insurance binders are various from the car insurance and home insurance binders talked about right here.

What Does Vehicle Insurance - Tax Commissioner's Office - Cherokee ... Mean?

All vehicles registered in New Jersey need three sorts of mandatory insurance: pays others for damages that you trigger if you are accountable for a crash. It does not cover clinical costs. pays medical expenses if you or other individuals covered under your plan are injured in a car accident.

shields you if you are in a crash with somebody that doesn't have proper insurance protection. Call your insurance coverage business for the various insurance policy protection choices or check the Department of Banking and Insurance policy web website See a list of accepted business accepted to create auto responsibility insurance coverage in the State of New Jersey.

trucks vehicle low cost auto cheapest car insurance

trucks vehicle low cost auto cheapest car insurance

In New Jersey, the insurance coverage identifiction card may be presented or provided in either paper or electronic type. For these objectives, "digital type" suggests the display of images on a digital device, such as a celular telephone, tablet or computer. automobile. Paper insurance card specs have not altered. You have to keep the card in the vehicle, or have the ability to produce the digital style: Before an assessment.

You should have recently gotten our "My, Loan, Insurance" welcome letter, noting that under the terms of your STCU financing, After 30 days, you must give insurance on the vehilcle without lapse in protection or danger breaking your financing contract. If you do not provide evidence of insurance policy before the 30-day due date, STCU will purchase insurance coverage for you at a premium that usually is much more pricey than what you could purchase yourself (insurance company).

Below are both easiest means to do it prior to your 30-day due date or at any moment that your automobile insurance coverage may gap: A read more trusted representative can supply the evidence of insurance coverage in a week or less. If it's easier, they can use this website and also the referral number and also individual identification number (PIN) you supply (see below) to publish your binder.

The Ultimate Guide To Manage Your Insurance Policy With The Root® App

You will be required to spend for this lender-placed insurance coverage plan, likewise referred to as "collateral security insurance," It is your obligation to pay for the lender-placed plan, despite the amount of days of coverage it supplies, as well as STCU can additionally charge you for breaching the finance agreement by letting your insurance lapse - cheaper.

What occurs if I allow my car insurance gap? As quickly as STCU is alerted that your plan has expired, we will certainly acquire insurance coverage for the automobile at a premium that typically is much more pricey than what you could purchase for yourself (insurance company). There is as well as you will be charged the insurance coverage costs for every day that protections is given.

Insurance is being bought for me. What should I do? If your insurance coverage agent recently offered STCU with evidence of insurance, get in touch with STCU right away to terminate the insurance we purchased for you. You will be accountable to pay all premiums applied to the time the plan insured your car - cheaper car insurance.

vans insurers vehicle insurance liability

vans insurers vehicle insurance liability

Ask your agent to give evidence of insurance policy to STCU, as explained above. When we obtain the evidence of insurance from your representative or firm, we will cancel the plan that was purchased for you. Nevertheless, you will certainly still be accountable to pay all premiums used to the time the plan insured your automobile.

Your property owner insurance policy binder will certainly consist of a summary of your home, the address of the residential or commercial property you have guaranteed, the kind of residential property you have insured, the name of your insurer as well as the coverages connected to your plan. perks. The Named Insured And Also Loss Payee The "named guaranteed" is mosting likely to be whomever possesses the plan this might be a specific or a pair.

Connecticut Insurance Indentification Card - Ct.gov Things To Know Before You Buy

A "loss payee" can be an individual or company that obtains listed on your insurance coverage as having the very first right to any kind of cases you may have filed to ensure that they can safeguard their economic rate of interest. Your lender would be an example of a loss payee. They would intend to ensure that if the home was shed due to a protected loss, they would still get paid out on any kind of staying home mortgage.

You will also locate the mailing address and also call details for both the insurance provider and also your agent (if you made use of one). Details On The Kind Of Insurance coverage Plan The insurance coverage binder will certainly likewise show the kind of insurance policy protection you carry your home. This could consist of personal effects insurance policy, general obligation insurance coverage, loss of use, clinical liability and various other frameworks coverage.

Made use of to cover points like your laptop computer, clothes or any one of your personal things if they are swiped, lost or destroyed as a result of a covered loss. If you have a removed garage, a family pet house or also a shed, your various other frameworks insurance coverage will certainly deal with this. Also called clinical settlements insurance coverage, it usually begins to cover medical costs if someone is hurt while visiting your home (perks).